MORGANTOWN – The West Virginia Center on Budget and Policy came to Morgantown Thursday evening to critique the tax cut plans brewing in the Legislature and to offer some ideas that they think are better uses for a budget surplus.

Center Executive Director Kelly Allen met with some residents around a table in the city library.

There’s a disconnect between the governor’s surplus projections and the realities of PEIA shortfalls, underpaid state employees and underfunded services. “I think people are just like, ‘Hey, where’s that money and why is it not getting to things we pay for as taxpayers.

The governor has proposed a series of flat budgets over the years, which helps account for the surpluses, she said. The Fiscal Year 2024 budget is projected at $4.884 billion, slightly less than this year’s $4.935 billion. “Flat budgets are creating real consequences for folks across the state, and they’re creating a lot of pent-up needs that we’ve just neglected to address in recent years.”

As MetroNews’ Brad McElhinny has reported here, West Virginia is running a budget surplus just shy of $1 billion. But that’s based on several factors, including high energy prices that have produced high-performing severance tax returns and artificially low state revenue projections that have enforced relatively flat budgets for several years in a row.

Allen added inflation-induced increased tax revenues to that mix, and said the surplus is essentially a fiction. And the surplus will be eaten up by increased expenses on the horizon: the Medicaid match, PEIA, corrections officers pay raises, the HOPE Scholarship and literacy/numeracy legislation for K-3 schools.

PEIA will need an additional $376.5 million by FY 2027, she said, and if no solution is found it would require a 54.1% premium hike.

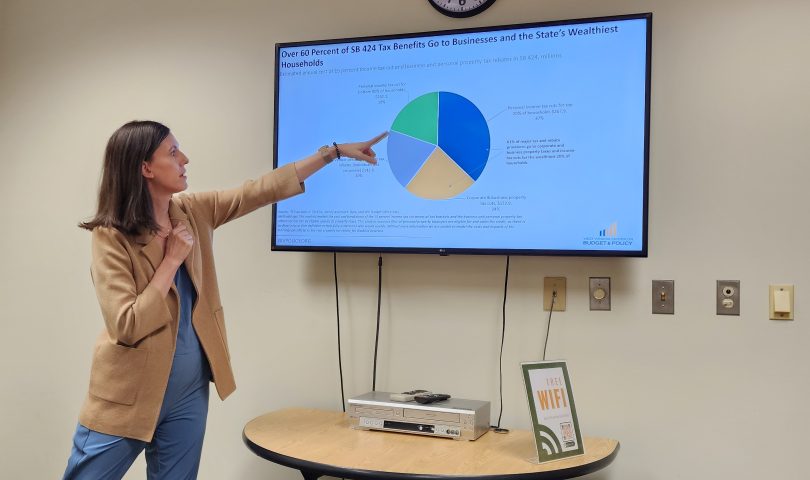

Allen said both the governor’s and the Senate’s tax-reduction plans favor the rich over the poor and middle class.

As Brad McElhinny has reported, the Senate plan starts with a 15% decrease in personal income tax. In out years, a 105% improvement of sales tax revenue over the previous year would trigger additional income tax cuts.

The plan also includes elimination of the “marriage penalty,” a rebate for the payment of taxes on vehicles, a homestead real property tax rebate for 90% to 100% service-disabled military veterans and a 50% rebate for the payment of equipment and inventory taxes paid by West Virginia small businesses.

Both the governor’s and Senate’s plans reduce income taxes proportionally. The Center criticizes that approach because lower income brackets pay in less and therefore see less of a return in terms of real dollars. Under the governor’s plan, the lowest 20% of earners net only $48 while the top 1% nets $23,583.

Under the Senate plan, she said, the bottom 80% of earners receive just 19% of the total tax cut benefits; the top 20% get 37%; 24% goes to corporate and business tax cuts; and 20% goes to the vehicle tax rebates.

The Center has some alternative ideas on how to use surplus funds, if they exist, Allen aid. The governor’s tax plan would cost the state budget $1.493 billion in FY 2026. The Center’s proposals would cost $1.438 billion.

The Center’s proposal: A child tax credit of $1,000 per child, for $350 million; close the PEIA shortfall to avoid premium increases, $376 million; a 10% state employee pay hike, $230 million; job training, $150 million (Allen noted that despite a series of corporate tax cuts designed to lure businesses and create jobs, West Virginia had the nation’s lowest job-growth rate for the decade 2009-2019); free, four-year in-state tuition, $125 million; paid leave for all state workers, $150 million; child-care subsidies for 10,000 children, $57 million.

Allen made it clear that she doesn’t think the state should really spend that because the surplus is only a mirage. “I do think it’s interesting to see what we could do for the cost.”

Tweet David Beard @dbeardtdp Email dbeard@dominionpost.com