MORGANTOWN — West Virginians awaiting student loan debt relief will be able to apply for that relief starting in early October.

In West Virginia, there are roughly 225,800 borrowers with $7.3 billion in student loan debt. The average West Virginia student loan debt is $31,690. And 50.3% of West Virginia borrowers are under 35, according to StudentAid.gov.

The state median income is $48,850, lower than the national average, so while exact numbers are not available now, it appears that a large number of those 225,800 borrowers will be eligible for forgiveness. The West Virginia Higher Education Policy Commissioner reports that the median income of degree holders — from two-year to doctorates — is under $125,000.

Here is a look at how the program will work, what West Virginia’s two U.S. senators think about the plan, and what it’s expected to cost taxpayers.

The plan

President Biden’s plan is spelled out at StudentAid.gov.

It will offer relief of $10,000 or, for those with Pell Grants, $20,000. The income threshold is $125,000 for individuals or married filing separately; or $250,000 for married filing jointly or head of household.

People seeking relief should go to StudentAid.gov to update their contact information or create an FSA ID if they don’t have one. The Department of Education will send updates by email and text message.

You must apply for relief online; the form will be available by early October. An exact date has not yet been announced. The deadline to apply is Dec. 31, 2023.

The Department of Education will determine eligibility. When you submit your application for debt relief, you’ll see a page online confirming your form was submitted. You’ll also get a confirmation email.

A parent who has taken out loans — including loans for their own studies or parent PLUS loans for their child — may qualify for debt relief if they meet the income eligibility criteria. If a parent also received a Pell Grant for their own studies, then the parent borrower may be eligible for up to $20,000 in relief on their loans. Otherwise, the parent borrower may be eligible for up to $10,000 in debt relief.

However, a parent who carries a PLUS loan and has a child with a Pell Grant may only receive relief for their own debt, not the child’s. If a dependent student received a Pell Grant, up to $20,000 in debt relief will be applied to the student’s loans — not to any loans their parent may have taken out.

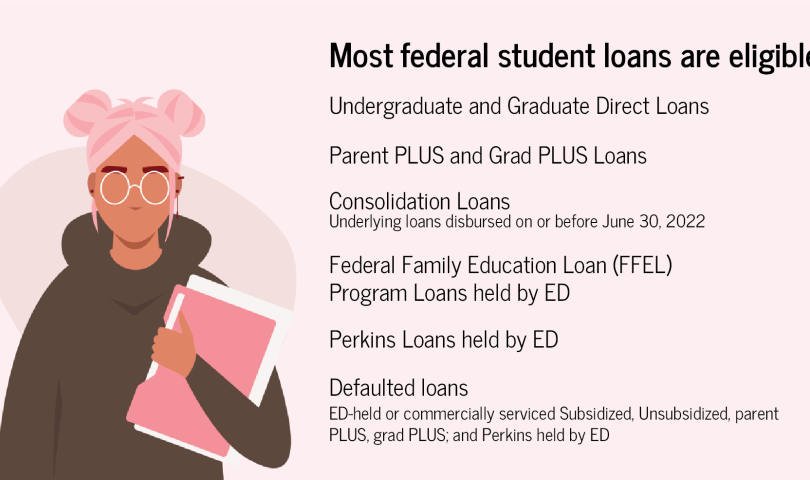

The following types of federal student loans with an outstanding balance as of June 30, 2022, are eligible for relief: William D. Ford Federal Direct Loan; subsidized loans; unsubsidized loans; parent PLUS loans; graduate PLUS loans; consolidation loans, as long as all of the underlying loans that were consolidated were first disbursed on or before June 30, 2022; Federal Family Education Loan Program loans held by the Department of Education (ED) or in default at a guaranty agency; federal Perkins Loan Program loans held by ED; defaulted loans (includes ED-held or commercially serviced subsidized Stafford, unsubsidized Stafford, parent PLUS, and graduate PLUS, and Perkins loans held by ED.

Private, non-federal loans are not eligible for debt relief. If you consolidated federal loans into a private loan, the consolidated private loan is not eligible for debt relief.

One-time student loan debt relief will not be subject to federal income taxes. State and local tax implications will vary. A recent report by the Tax Foundation (quoted in Forbes) erroneously reported that West Virginians would be subject to state taxes. The governor’s office told The Dominion Post that the error was subsequently corrected and that residents obtaining relief won’t be subject to state taxes.

Loan balances remaining after relief will be re-amortized, meaning ED will recalculate your monthly payment based on your new balance, potentially reducing your monthly payment. Your loan servicer will communicate your new payment amount to you.

Senators’ comments

The plan has faced strong opposition. Critics have said it’s unfair to those who’ve paid their loans; saddles those who’ve paid and those who never took loans with debt they deserve; will add to the national debt and stir more inflation; and is outside’s the president’s purview.

U.S. House Speaker Nancy Pelosi has done a U-turn on her opinion. She said in 2021: “People think that the president of the United States has the power for debt forgiveness. He does not. He can postpone. He can delay. But he does not have that power. That has to be an act of Congress.”

Then in August she said she “didn’t know … what authority the president had to do this. And now clearly, it seems he has the authority to do this.”

Both of West Virginia’s senators oppose the plan. Sen. Joe Manchin told The Dominion Post, “I believe there are better ways to help West Virginians and Americans pay off their student loans that help them give back to our state and nation without adding to our national debt.”

Sen. Shelley Moore Capito told The Dominion Post, “President Biden used authority he does not have to spend money we also do not have on a scheme that will not lower the overall cost of college for students across this country. As a member of the Senate Appropriations Committee, and frankly of the Senate, it is the height of arrogance that the Biden administration would attempt this type of action without Congressional consultation or action.”

She previously said, “West Virginians are fair-minded people, and they want to help those in need, but President Biden’s student loan transfer is far from fair, and would create additional financial burden for taxpayers struggling during a time when they are paying higher prices for things they can’t live without.”

The cost

The Dominion Post asked Manchin and Capito what’s the pay-for for Biden’s plan — who covers the cost of the debt forgiveness.

Manchin didn’t expand beyond his statement above. Capito said, “There isn’t a pay-for. Also worth noting is that, ironically, just days after the Biden administration had been touting savings in their so-called Inflation Reduction Act, they have now spent those with this bailout.”

The White House is reported saying the plan is fully paid for through deficit reduction that is already occurring. Bharat Ramamurti, deputy director of the National Economic Council, is cited in media reports saying “We’re on track for $1.7 trillion in deficit reduction this year. That means, practically speaking, compared to the previous year, 1.7 trillion more dollars are coming into the Treasury than are going out. And we’re using a portion of that — a very small portion of it — to provide relief to middle-class families, consistent with the president’s plan.”

The Committee for a Responsible Federal Budget estimates that the debt cancellation will eliminate $525 billion of federal student loan debt. It projects that the overall amount of outstanding federal student loan debt will return to $1.6 trillion, its current level, in 2028.

“The changes announced … will likely cost more than double the amount saved through the recently passed Inflation Reduction Act, completely eliminating any disinflationary benefit from the bill.”

The student debt cancellation and relief measures, the committee said, would cost around $500 billion over a decade and would boost inflation by 15 to 27 basis points over the next year.

“The student debt changes will increase inflation in three ways — by reducing the amount of income households use to pay down debt over the next year, by increasing household wealth, and by putting upward pressure on tuition costs.

“Debt cancellation may drive up tuition prices by creating the expectation of future debt cancellation, thereby increasing willingness to borrow among prospective students. Studies have shown that these effects can lead students and parents to be less sensitive to the cost of tuition, which could encourage colleges and universities to further hike tuition and fees.”

The Penn Wharton Budget Model puts an even higher price tag on the plan. It looks at all three aspects of Biden’s plan: the debt forgiveness described above; the extension of the current loan forbearance through Dec. 31; and the new Income-Driven Repayment plan that will cap monthly payments, cover unpaid interest, raise the income cap and forgive loan balances after 10 years of payments, instead of 20, for borrowers with original loan balances of $12,000 or less.

The debt cancellation, Penn Wharton said, will cost up to $519 billion, with about 75% of the benefit going to households making $88,000 or less. The loan forbearance extension will cost another $16 billion.

The new IDR program would cost another $70 billion, Penn Wharton said. “However, depending on future IDR program details to be released and potential behavioral changes, total plan costs could exceed $1 trillion.”

TWEET David Beard @dbeardtdp

EMAIL dbeard@dominionpost.com