Let’s take a look at the residential real estate market in the month of October as compared to October of 2019.

Welcome to the Mon County Market Snapshot brought to you by White Diamond Realty. Let’s take a look at the residential real estate market in the month of October as compared to October of 2019. The following shows our continued trend of atypical market activity in the area, which I will delve into a bit after the good stuff.

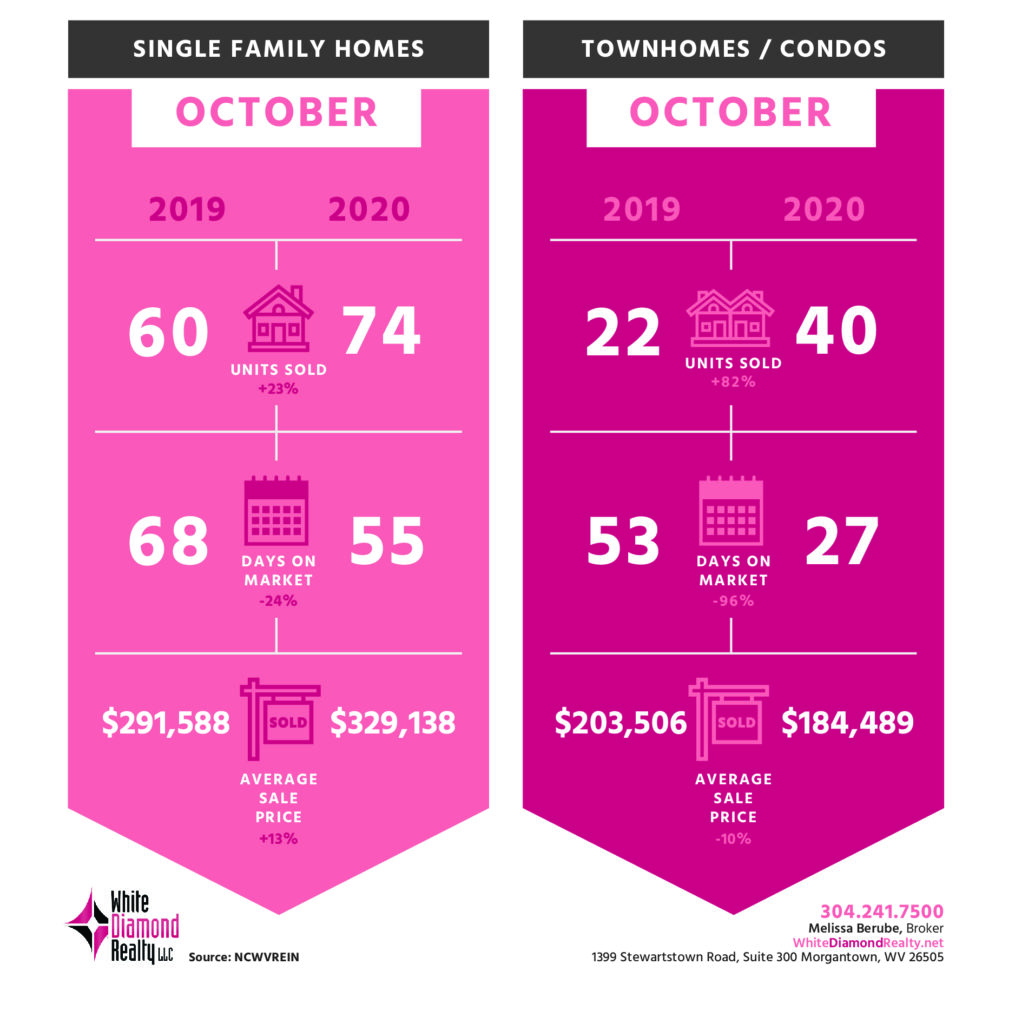

Single Family homes showed another month of extraordinary activity this year over last! All the categories were above and beyond 2019. There were 74 units sold which was a bit over 23% more than this time last year at 60, and the average sales price was just over nearly 13% higher at $329,138 as compared to $291,588 in 2019. Homes not only sold higher in volume and price, but they also sold over 23% faster at 55 days on market instead of 68 as in 2019!

If you recall from last month the September numbers for attached homes were astounding, and apparently the trend continued into October. The unit count was up over last year by nearly 82% at 40 units sold compared to 22. They sold almost twice as fast with an average of 27 days on market last month compared to 53in 2019, a 96% decrease. The average sales price is the only category that didn’t see ‘improvement’ with a decrease from 2019 of about 10% from $203,506 to $184,489. This, however, does not indicate a slump in value in my opinion. Given the drastic volume and speed they are selling I believe this is reflecting a changing audience, not value. This is showing that persons who were not previously able to be in the buying market now are due to the continued low rates as well as investors taking advantage of the rates to start or increase their rental portfolio.

Given the unprecedented market we’ve been seeing not just in our area, but across the country concerns and speculations about a repeat of the early 2000s have been bubbling to the surface. I wanted to take this opportunity to give my perspective on the difference in the two markets.

I started my real estate career in the 2000 ‘aughts’ right when the boom was starting. To say it was a feeding frenzy is a gross understatement. Granted I was in a different market, but it was extremely chaotic and resembled more the Wild West than an economic market. The fuel of that market is the difference. That real estate boom, and consequential economic bust, was being driven by large banks and investment entities’ speculative and false inflation of value and trading. The ‘big banks’ were handing out money to anyone with a pulse, and I mean that almost literally. They were allowing for stated income loans – that is when you tell them your income without the need to provide documentation – and desk top appraisals that were done without anyone visiting the property, they simply made the numbers work. The driving force behind this was greed, with no thought to the implications on middle America who were being caught up in the frenzy.

So, what’s the difference now? The driving force. The economic ripple effect from industries and trade being shut down in an effort to control and contain the virus is what we’re seeing, not manipulation by a select few. Organic as opposed to lab created, so to speak. The fed has drastically lowered the rates to encourage exactly what is happening. It is stimulating the economy by making goods and services more affordable in order to keep our engines moving forward in these unprecedented times. This is slow, controlled, and monitored. Will it last forever? Absolutely not. Will it come to a crashing halt once we’re on the verge of getting back to normal? In my opinion, nope to that as well. In a means to control inflation and growth the feds will gradually and with purpose increase the rates when it’s time to balance inflation for the good of our economy.

The real estate market is not only the pulse of our economy, it’s also the strongest asset in most of our portfolios. Being in the know for both the big picture and the individual one is always a good idea, and we at White Diamond Realty hope this monthly article helps shed some light. If you’ve been considering buying but aren’t sure of your options, we can help. If you already own your home and wish to discuss the potential value and current equity of your home, feel free to give White Diamond Realty a call. Our local expert agents are in the trenches every day and here to advise you on how best to navigate the real estate market. Whether you’re trading up, paring down, or getting started, having a professional by your side to help every step of the way is imperative to making what is most likely the largest transaction of your lifetime a well informed and expertly executed one. Never high-pressure sales. Always high-quality service. We can be reached by phone at 304-241-7500, email at info@whitediamondrealty.net, or online at whitediamondrealty.net. Feel free to connect with us on Twitter, Instagram, and Facebook, too! Just search and follow White Diamond Realty LLC to get updates on all things real estate and our community as a whole. Tune in next month to see what November has in store for us here in Monongalia county. Until then stay healthy and do your best to enjoy the holidays to come…

304.241.7500

Melissa Berube, Broker

WhiteDiamondRealty.net

1399 Stewartstown Road, Suite 300 Morgantown, WV 26505